24+ crypto mortgage lending

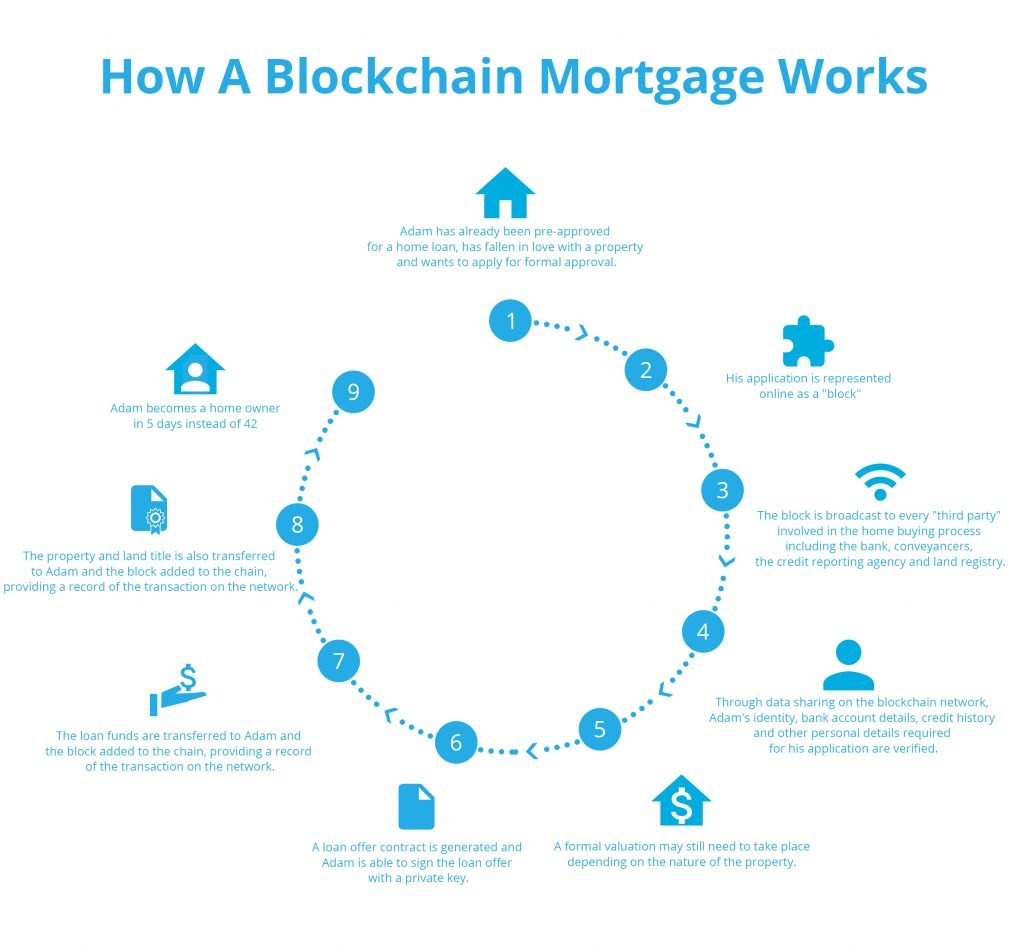

Web With a cryptocurrency loan a borrower typically offers up their cryptocurrency as collateral to the lender who gives them cash or a stablecoin cryptocurrency thats tied. Web CMC Crypto 200.

Crypto Backed Mortgages Are Here And More Options Are On The Way Tearsheet

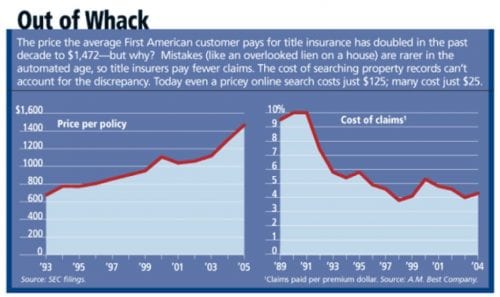

Web Still crypto has become a pretty big asset class and yielded huge capital gains to many buyers.

. Web While Milo says its the first lender using bitcoin as collateral for a mortgage the concept of leveraging against crypto is not new. A basis point is equivalent to. A handful of lenders including.

Web Milo Mortgage provides US. By pledging your crypto your rate could be as low as 895. Youll pay more every month with a 10-year.

Web 1 day agoThe APR was 690 last week. Web Borrow up to 100 of the purchase price with a crypto mortgage. CreditNinja NinjaCard and NinjaEdge.

Crypto-backed mortgages with a minimum of 200000 and a maximum of 500000. The basic principle works like a. February 24 2023 927 AM.

Its a 30-year product that lets you leverage. Web For 10-year fixed refinances the average rate is currently at 643 an increase of 20 basis points over last week. APR is the all-in cost of your loan.

Get an instant loan. Web Todays 30-year mortgage refinance rate climbs 014. Web Ethereum is the primary network that developers use to build decentralized platforms for crypto borrowing lending trading and more.

Web Borrowers can then make their monthly payments in either crypto or traditional cash. With todays interest rate of 701 a 30-year fixed mortgage of 100000 costs approximately 666. Calculate your rate Loan amount 1000000 Crypto.

Web Crypto lending has become one of the most successful and widely used DeFi services and many crypto exchanges and other crypto platforms offer borrowing. The average 30-year fixed-refinance rate is 703 percent up 14 basis points from a week ago. If you need a loan.

Web Borrow crypto loans from the most flexible crypto lending platform. Web As crypto loans are a new concept in the lending industry there are alternatives to choose from if you need extra cash. Web The company offers three products.

The companys interest rate starts from 895. By last fall the combined market value of cryptocurrencies had. Web Payment on the loan over the 30-year term can be paid in cash or with the crypto collateral and would bear an interest rate of between 3 and 599 according to.

Web 1 day agoThe average interest rate for a standard 30-year fixed mortgage is 694 which is a growth of 15 basis points compared to one week ago. CreditNinja allows underserved demographics to receive personal loans. Web Figures Crypto Mortgage PLUS amounts range from a minimum of 75000 to a maximum of 3000000.

You may not be eligible for our maximum amount which varies based on. Web How crypto lending works A cryptocurrency-backed loan uses digital currency as collateral similar to a securities-based loan. Web If you havent heard the news a company called Milo is now offering the worlds first crypto-backed mortgage loan.

Rates are generally between 395 and 595 which is in line with the. Per sources the latest reductions have affected more than 500 employees including. High LTV flexible repayment and you can take the loan off the platform for trading.

Ether is the cryptocurrency or.

Crypto Mortgages 2023 Crypto Backed Mortgage Loans

Blockchain Mortgage The Future Of Home Loans Mortgage Rates Mortgage News And Strategy The Mortgage Reports

Australian Broker 15 21 By Key Media Issuu

Fannie Mae And Freddie Mac Will Require The Use Of Fico Score 10 T

Crypto Home Loans Are Here Bitcoin Backed Mortgages Bitcoin Crypto Loans Crypto News Today Youtube

Mortgage With Crypto Miami Financial Tech Company Allows Bitcoin As Collateral Nbc 6 South Florida

Crypto Mortgages 2023 Crypto Backed Mortgage Loans

Get An Instant Crypto Loan Borrow Crypto Instantly Online How To Lend Cryptocurrency With Collateral Lending Site App Wallet

How To Pay Mortgage With Bitcoin Nowpayments

Bitcoin Definition Financial Dictionary Fxmag Com

Gonzalo Diaz Cordoba Gdiazcordoba Twitter

Nordea Bank

6pg0hdsxgx Q2m

Blockchain Mortgage A Cheaper And Faster Home Loan

The Crypto Mortgage Arrives At A Price Observer

Qt At The Bank Of Canada Assets Down 24 From Peak Spiraling Losses On Bonds To Be Paid For By Canadians Wolf Street

Distributed Ledger Technologies Cryptocurrencies The Wealth Mosaic